Debt-to-Income Ratio Explained: A Crucial Factor in Mortgage Approval

If you’re considering applying for a mortgage, you’ve likely come across the term “debt-to-income ratio” or DTI. But what exactly is it, and why is it crucial in the mortgage approval process? Let’s delve into the details and understand the significance of this key financial metric.

What is Debt-to-Income Ratio (DTI)?

The debt-to-income ratio is a financial metric that measures the percentage of your gross monthly income that goes toward paying debts. Lenders use this ratio to assess your ability to manage monthly payments and determine the amount of mortgage you can afford.

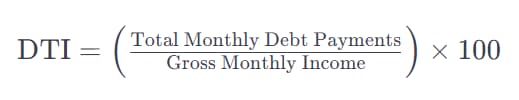

The formula for calculating DTI is simple:

Components of Debt-to-Income Ratio

Total Monthly Debt Payments

- Includes mortgage or rent payments.

- Credit card minimum payments.

- Car loans.

- Student loans.

- Other monthly debt obligations.

Gross Monthly Income

- Your total income before taxes and other deductions.

- Includes salary, bonuses, alimony, rental income, and other sources.

Why is DTI Important?

Lender’s Risk Assessment:

Lenders use the debt-to-income ratio to evaluate the level of risk associated with lending to you. A lower DTI suggests that you have a manageable level of debt relative to your income, making you a lower risk for default.

Loan Eligibility

Your DTI plays a significant role in determining the amount of loan you qualify for. Lenders generally prefer a DTI below 43%, although specific requirements may vary.

Financial Stability

A lower DTI indicates financial stability and the ability to take on additional debt responsibly. This can positively impact your mortgage interest rate and terms.

Understanding Acceptable DTI Levels

Front-End DTI

- This includes housing-related expenses (mortgage, property taxes, insurance).

- Ideally, it should be below 28%.

Back-End DTI

- This includes all monthly debts.

- It should typically be below 36%, although some lenders may accept up to 43%.

Improving Your DTI Ratio

If your DTI is higher than recommended, consider the following strategies

Pay Down Existing Debt:

- Focus on paying off high-interest debts to reduce monthly payments.

Increase Income:

- Explore opportunities to increase your income, such as a side job or freelance work.

Budget Wisely:

- Create a budget to better manage your finances and allocate funds more efficiently.

Avoid New Debt:

- Refrain from taking on additional debt, especially before applying for a mortgage.